Dental insurance is essential to any healthcare plan, providing coverage for dental procedures and treatments. In South Africa, several dental insurance options are available to individuals and families. Dental insurance is designed to help cover the cost of dental care, including routine check-ups, cleanings, and more complex procedures like root canals and fillings.

One of the major benefits of dental insurance is that it can help reduce the cost of dental care. With affordable premiums, individuals and families can know they are protected in case of unexpected dental expenses. Dental insurance can also help encourage regular dental visits, preventing more serious dental issues from developing.

When considering dental insurance options in South Africa, it is important to research and compare plans to find one that best meets your needs and budget. Factors to consider include the level of coverage, premiums, and deductibles. With the right dental insurance plan, individuals and families can access quality dental care at an affordable price.

Understanding Dental Insurance

Dental insurance is a type of insurance policy that covers the cost of dental care. It is a separate insurance policy from medical insurance, although some employers offer a benefit package that includes medical and dental insurance.

Dental insurance policies typically cover a range of dental treatments, including consultations, root canals, fillings, crowns, wisdom teeth extractions, x-rays, and dentures. Some policies may offer preventative care such as cleaning, polishing, and infection control.

To obtain dental insurance, an individual or employer will pay premiums to an insurer. The premium amount will depend on the level of coverage and the insurer.

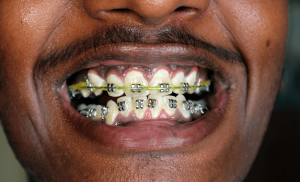

It is important to note that dental insurance policies may have limitations and exclusions. For example, some policies may not cover cosmetic dental procedures or orthodontic treatment. It is important to carefully review the policy before selecting a plan to ensure that it meets the individual’s or employer’s needs.

In summary, dental insurance is a separate insurance policy that covers the cost of dental care. It is obtained by paying premiums to an insurer and typically covers a range of dental treatments. However, it is important to review the policy carefully to ensure that it meets the individual’s or employer’s needs and to be aware of any limitations or exclusions.

Dental Insurance in South Africa

Dental insurance in South Africa is an important aspect of healthcare coverage that provides financial protection against the high cost of dental treatment. Dental insurance plans offer partial or full coverage for dental procedures and can be a standalone dental cover or a top-up for medical aid dental benefits.

Affinity Dental is one of the fastest-growing dental insurance providers in South Africa, offering cost-effective dental care plans starting from just R279 per month. They provide comprehensive dental insurance coverage for individuals and families, with options for medical and non-medical aid members.

Many medical schemes in South Africa also offer dental coverage as part of their healthcare benefits. It is important to note that dental coverage under medical schemes is often limited and may have waiting periods and exclusions. Therefore, it is recommended to consider standalone dental insurance plans to supplement medical aid dental benefits.

InsurancePlus offers competitive dental cover in South Africa from leading dental cover providers. They provide private dental insurance at affordable prices, ensuring that individuals can maintain good dental health and financial protection.

Zestlife offers dental coverage as a health insurance policy to assist individuals and families in funding the high cost of private dentistry. Their dental cover solution is available to medical and non-medical aid members.

In conclusion, dental insurance in South Africa is an essential aspect of healthcare coverage that provides financial protection against the high cost of dental treatment. Dental insurance plans offer partial or full coverage for dental procedures and can be a standalone dental cover or a top-up for medical aid dental benefits. It is important to consider the available options carefully and choose a plan that suits individual needs and requirements.

Types of Dental Insurance Plans

Dental insurance plans in South Africa are available in different types, from basic coverage to comprehensive plans covering a wide range of dental treatments.

Silver Plan

A silver plan is a basic dental insurance plan that covers basic dental care, such as regular check-ups, cleaning, and fillings. This plan is suitable for individuals who require routine dental care and want to avoid paying out-of-pocket expenses for basic dental services.

Platinum Plan

A platinum plan is a comprehensive dental insurance plan that covers a wide range of dental treatments, including orthodontics, periodontics, and cosmetic dentistry. This type of plan is suitable for individuals who require extensive dental care and want access to a wide range of dental services without worrying about the cost.

Dental Plans

Dental plans are not medical aids but offer a range of benefits to partially or fully cover the cost of dental treatment. These plans are designed to assist individuals in affording quality dental care when they need it the most. Dental plans may include basic dental care, such as regular check-ups, cleaning, and fillings, or more extensive dental treatments, such as orthodontics and cosmetic dentistry.

Top Up Cover

Top-up cover is a dental insurance plan that supplements an existing dental plan or medical aid. This type of plan is suitable for individuals who want additional coverage for dental treatments not covered by their existing plan or medical aid.

Overall, there are different types of dental insurance plans available in South Africa that cater to the varying needs of individuals. It is important to carefully consider one’s dental needs and budget when choosing the right plan.

Benefits of Dental Insurance

Dental health is a crucial aspect of overall health, and maintaining it can be expensive. Without dental insurance, the high cost of procedures such as root canals and fillings can significantly burden your finances. Dental insurance provides coverage for a range of dental treatments, making it a cost-effective and affordable way to ensure that you and your family receive the necessary dental care.

Here are some of the benefits of dental insurance:

- Coverage for preventative care: Dental insurance plans often cover preventative services such as cleaning, polishing, and infection control. These services help maintain good oral health and prevent the need for more expensive treatments.

- Cost-effective: Dental insurance can help to reduce the cost of dental treatments significantly. With dental insurance, you can receive the necessary dental care without worrying about the financial burden.

- Access to a network of dentists: Most dental insurance plans have a network of dentists you can choose from. These dentists have agreed to provide services at a discounted rate, making dental care more affordable.

- Comprehensive coverage: Dental insurance plans offer coverage for various dental treatments, including root canals, fillings, crowns, wisdom teeth extractions, x-rays, and dentures. This comprehensive coverage ensures you can receive the necessary treatment without worrying about the cost.

In conclusion, dental insurance provides a range of benefits that make it cost-effective and affordable to ensure you and your family receive the necessary dental care. With coverage for preventative care, access to a network of dentists, and comprehensive coverage for a range of dental treatments, dental insurance is a valuable investment in your oral health.

Dental Insurance for Family

Dental insurance is an excellent way to ensure your family’s oral health is well cared for. Dental insurance for families covers a range of dental procedures, including routine check-ups, fillings, extractions, and emergency dental care.

When choosing dental insurance for your family, it is essential to consider the needs of each family member. For example, if you have children, you may want to look for a policy that covers orthodontic treatment, such as braces.

Most dental insurance policies for families cover two adults and up to four children. However, some policies may have different limits, so it is important to read the policy documents carefully.

Dental insurance for families typically offers a range of benefits, including:

- Coverage for routine check-ups and cleanings

- Coverage for fillings and extractions

- Coverage for root canals and crowns

- Coverage for emergency dental care

- Coverage for orthodontic treatment (in some policies)

It is important to note that dental insurance policies for families may have waiting periods before certain procedures are covered. For example, there may be a waiting period of six months before orthodontic treatment is covered.

When choosing dental insurance for your family, shopping around and comparing policies is important. Look for a policy that offers the coverage you need at a price you can afford.

In summary, dental insurance for families is an excellent way to ensure that your family’s oral health is well cared for. When choosing a policy, consider the needs of each family member and shop around to find the best coverage at an affordable price.

Choosing the Right Dental Plan

When choosing a dental insurance plan in South Africa, there are a few things to consider. Dental plans vary in coverage, cost, and benefits, so choosing the right plan for your needs and budget is important.

One important factor is whether the plan offers coverage for your preferred network dentist. Some plans may limit your choice of dentists to a specific network, while others may allow you to choose any licensed dentist. It’s important to check if your preferred dentist is in the plan’s network to avoid unexpected out-of-pocket expenses.

Another factor to consider is the plan’s coverage for innovative dental procedures. Some dental plans may offer range for new and innovative treatments, while others may only cover basic dental care. If you’re interested in a specific dental procedure, checking if the plan covers it before enrolling is important.

When comparing dental plans, it’s also important to consider the plan’s cost and benefits. Some plans may have lower monthly premiums but higher out-of-pocket costs, while others may have higher monthly premiums but lower out-of-pocket costs. It’s important to weigh each plan’s cost and benefits to determine which is the best fit for your budget and dental needs.

Choosing the right dental plan in South Africa requires careful consideration of your preferred network dentist, coverage for innovative dental procedures, and cost and benefits. By comparing and evaluating different plans, you can find the one that best fits your needs and budget.