South Africa’s banking industry has seen significant growth over the years, with major players emerging as the top banks in the country. These banks have the largest assets, revenue, and customer base, making them the most influential in the industry. In this article, we will take a closer look at the top 10 biggest banks in South Africa.

According to recent reports, Standard Bank is currently the largest bank in South Africa in terms of revenue. The bank earned R113 billion in 2021, making it a significant player in the industry. Other banks that make up the top five include First National Bank, Absa Group, Nedbank, and Investec.

While these banks dominate the industry, there are also other notable players that have shown significant growth in recent years. These banks include Capitec Bank, African Bank, and TymeBank. With the industry’s continued growth, it is expected that these banks will continue to make a significant impact in the coming years.

Understanding the South African Banking Sector

South Africa’s banking industry is considered one of the most sophisticated and well-developed in Africa. It plays a vital role in the country’s economy by providing financial services to individuals, businesses, and government entities.

Four major banks dominate the South African banking sector, called the “Big Four.” These banks are Standard Bank, FirstRand, Absa, and Nedbank. They collectively hold over 80% of the market share in terms of assets and deposits.

Apart from the Big Four, several other smaller banks and financial institutions operate in the country. These include Capitec Bank, African Bank, and Investec, among others.

The South African Reserve Bank (SARB) is the country’s central bank and is responsible for regulating and supervising the banking industry. It oversees the operations of all banks operating in the country and ensures that they comply with the relevant regulations and laws.

The banking industry in South Africa is highly competitive, with banks offering a wide range of financial products and services. These include personal and business loans, savings and investment accounts, credit cards, insurance, and foreign exchange services.

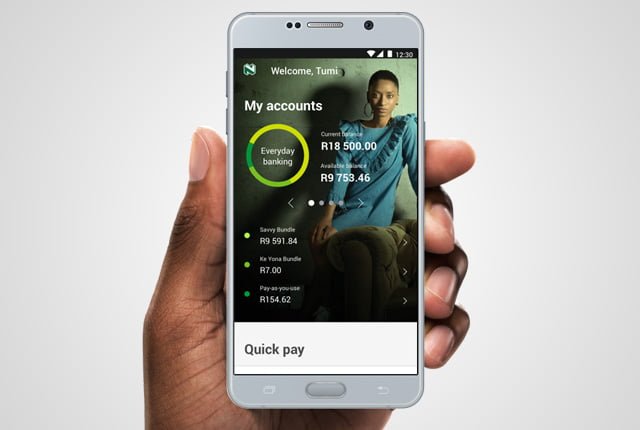

The South African banking sector has also adopted new technologies, such as mobile and online banking, to provide customers with convenient and efficient banking services. This has helped to increase financial inclusion in the country, particularly among the unbanked population.

Overall, the South African banking sector is vital to the country’s economy, providing essential financial services to individuals, businesses, and government entities. Its continued growth and development are crucial to ensuring the stability and prosperity of the country’s economy.

Top 10 Biggest Banks in South Africa

South Africa’s banking sector is one of Africa’s largest and most advanced. The country has a well-developed financial system, with various financial institutions offering various financial products and services. Here are the top 10 biggest banks in South Africa.

- Standard Bank Group

Standard Bank Group is the largest bank in South Africa by assets and market capitalisation. It is a leading financial services provider in Africa, in 20 countries. The bank offers a range of financial products and services, including personal and business banking, investment banking, and wealth management.

- FirstRand Bank

FirstRand Bank is the second-largest bank in South Africa by assets and market capitalisation. It is a diversified financial services group with a portfolio of businesses that includes retail and commercial banking, investment banking, and asset management.

- Absa Group

Absa Group is the third-largest bank in South Africa by assets. It offers a range of financial products and services, including personal and business banking, wealth management, and investment banking. The bank has a presence in 12 African countries.

- Nedbank Group

Nedbank Group is the fourth-largest bank in South Africa by assets. It is a diversified financial services group with a portfolio of businesses that includes retail and commercial banking, investment banking, and wealth management.

- Investec Bank

Investec Bank is a specialist bank and asset manager operating in South Africa and other countries worldwide. It offers a range of financial products and services, including private banking, wealth management, and investment banking.

- Capitec Bank

Capitec Bank is a retail bank that offers a range of financial products and services to individuals and businesses in South Africa. It is the sixth-largest bank in the country by assets.

- African Bank

African Bank is a retail bank that offers a range of financial products and services to individuals and businesses in South Africa. It is the seventh-largest bank in the country by assets.

- Discovery Bank

Discovery Bank is a retail bank that offers a range of financial products and services to individuals and businesses in South Africa. It is a subsidiary of Discovery Limited, a South African financial services group.

- TymeBank

TymeBank is a digital bank that operates in South Africa. It offers a range of financial products and services, including savings accounts and personal loans.

- Bidvest Bank

Bidvest Bank is a commercial bank that offers a range of financial products and services to businesses in South Africa. It is a subsidiary of Bidvest Group, a South African conglomerate.

These are the top 10 biggest banks in South Africa, ranked by assets. Each of these banks offers a range of financial products and services to individuals and businesses in the country.

Conclusion

In conclusion, the South African banking sector is dominated by a few major banks that continue to grow and expand their domestic and international operations. Standard Bank remains the largest bank in South Africa, followed by FirstRand and Absa. These banks have consistently performed well in revenue, customer approval, and financial stability.

Despite economic uncertainty and increased competition, South Africa’s major banks have delivered strong financial performance. In 2021, the combined headline earnings of the major banks increased by 99% against FY20, while the combined ROE was 15.9%.

Furthermore, South Africa’s banking sector is increasingly digitized, with many banks investing in digital platforms and technologies to improve their services and reach more customers. This trend is expected to continue in the coming years, with more banks focusing on innovation and technology to remain competitive.

Overall, the future of South Africa’s banking sector looks promising, with the major banks continuing to drive growth and innovation in the industry. As the economy recovers and new opportunities emerge, these banks are well-positioned to take advantage of the changing landscape and deliver value to their customers and shareholders.